Money Laundering Explained For Dummies

The idea of money laundering is essential to be understood for those working within the financial sector. It's a process by which soiled money is converted into clean cash. The sources of the cash in precise are legal and the money is invested in a method that makes it seem like clean money and conceal the id of the prison a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new clients or maintaining existing clients the obligation of adopting ample measures lie on each one who is part of the group. The identification of such component at first is simple to deal with instead realizing and encountering such conditions in a while in the transaction stage. The central bank in any country provides complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such conditions.

Laws that prohibit activities connected to money laundering. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations.

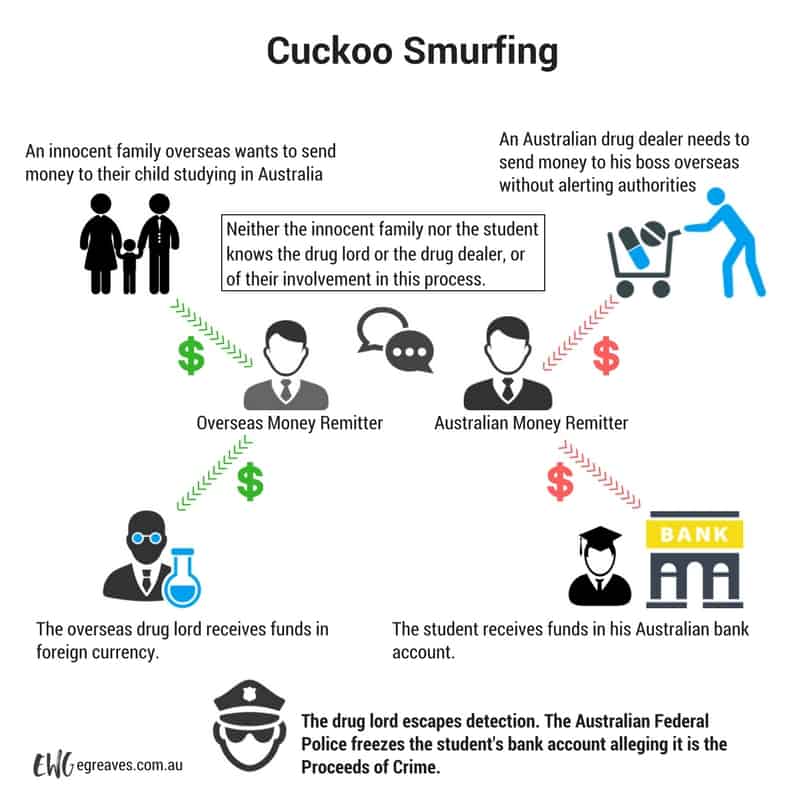

Cuckoo Smurfing Explaining A Money Laundering Methodology

She knows the source of the money and wonders if killing him now gives her the most amount of money or not and if she is ready to launder the money for the cartel or for herself.

Money laundering explained for dummies. These regulations mean firms have to. Criminals do money laundering to make it hard for the police to find out where the criminal got the money. Obtain records of all relevant customer interactions.

In practice criminals are trying to disguise the origins of money obtained through illegal activities so it looks like it was obtained from legal sources. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. Simultaneous puts and calls representing mirror-image bets on a.

Early on in his 247-page report he defines money laundering as the process by which money obtained through illegal activity is introduced into legitimate financial intermediaries where the source of funds is obscured by more than one further transaction creating an appearance of legitimacy. One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. Laundering money requires the basic illusion that your business can make a profit.

Julia Garner plays Ruth Langmore who is trying to kill Marty and eventually rob him. She shows some true spirit and you can feel the conflict into timing his death. German said there is dirty money and black money.

Money laundering is something some criminals do to hide the money they make from crimes. Money laundering is a way to conceal illegally obtained funds. There are many US.

First of all conducting a transaction that is intended to obscure the ownership or the source of the assets. Money laundering is a criminal scheme that can operate in a similar way but it involves the hiding of money rather than a ball. This page highlights some specific new areas that firms need to comply with.

Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. This immediately rules out things in TT like calypso tents TTT and preventative flood plans. The money laundering procedures force businesses to put in place policies to prevent potential money laundering fraud or other associated organised crimes.

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Maybe the most important of these are the Anti-Money Laundering provisions that criminalize behavior that involves two basic elements. Money laundering at its simplest is the act of making money that comes from Source A look like it comes from Source B.

Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

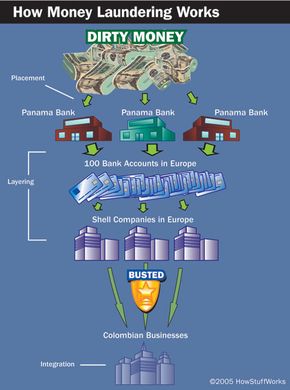

How Money Laundering Works Howstuffworks

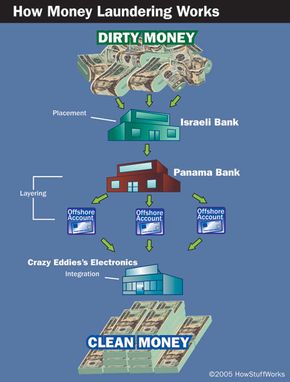

What Is Money Laundering Three Methods Or Stages In Money Laundering

Understanding Money Laundering European Institute Of Management And Finance

Money Laundering Define Motive Methods Danger Magnitude Control

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

How Money Laundering Works Howstuffworks

What Is Anti Money Laundering Aml Anti Money Laundering

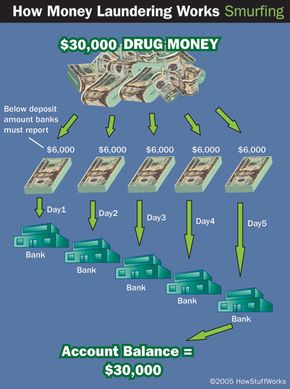

How Money Laundering Works Howstuffworks

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

What Is Money Laundering And How Is It Done

Cryptocurrency Money Laundering Explained Bitquery

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

How Money Laundering Works Howstuffworks

The world of regulations can seem to be a bowl of alphabet soup at occasions. US money laundering rules are no exception. We have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Threat is consulting agency targeted on defending financial providers by lowering threat, fraud and losses. We now have large bank experience in operational and regulatory threat. We have now a robust background in program management, regulatory and operational danger as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many opposed consequences to the group as a result of risks it presents. It will increase the probability of main dangers and the opportunity value of the bank and finally causes the bank to face losses.

Comments

Post a Comment